tax break refund tracker

Tax Refund Processing. The 10200 is the amount of income exclusion for single filers not the amount of the refund.

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Once you receive confirmation that your federal return has been.

. The first 10200 of 2020 jobless benefits or 20400 for married couples filing jointly. If you entered your information correctly. Your Social Security number or Individual Taxpayer Identification.

The IRS will determine whether the check was cashed. Irs Unemployment Tax Refund Status Tracker The irs has sent 87 million unemployment compensation refunds so far. Generally speaking the sooner you file the sooner you will get your tax refundThe turnaround is normally pretty fast.

Start checking status 24 48 hours after e-file. Calling the IRS at 1-800-829-1040 Wait times to speak to a representative may be long Looking for emails or status updates from your e-filing website or software. Track the status of your federal refund on the IRS website.

Using the IRS Wheres My Refund tool. The exact whole dollar amount of their refund. The Wheres My Refund tool can be accessed hereIf you filed an amended return you can check the Amended Return Status tool.

Well help you track. Still Waiting On Your 10 200 Unemployment Tax Break Refund How To Check The Status. Tracing a Refund Check Thats Gone Missing.

Learn How Long It Could Take Your 2021 Tax Refund. To check the status of your 2021 income tax refund using the IRS tracker tools youll need to provide some personal information. You will need your Social security number or ITIN your filing status and your exact refund amount.

These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset debt. Ad Learn How to Track Your Federal Tax Refund and Find The Status of Your Paper Check. Theres a process in place in case you lose your paper check or if it goes missing.

Either way its important to temper your expectations in terms of your wait time. Whether you owe taxes or youre expecting a refund you can find out your tax returns status by. Once you prepare and submit your return your e-file status is pending.

Refund for unemployment tax break. Using the IRS tool Wheres My Refund go to the Get Refund Status page enter your SSN or ITIN filing status and exact refund amount then press Submit. Going to wwwirsgov.

Check For the Latest Updates and Resources Throughout The Tax Season. Once you have e-filed your tax return you can check your status using the IRS Wheres My Refund. If you e-filed you can start checking as soon as 24 hours after the IRS accepts your e-filed return.

To track your state refund select the link for your state from the list below. If youre looking for your federal refund instead the IRS can help you. One way to know the status of your refund and if one has been issued is to wait for the letter that the IRS sends taxpayers whose returns are corrected.

You may also see TAX REF in the description field for a refund. Choose Wheres My Refund. Another way is to check your tax transcript if you have an online account with the IRS.

Once youve filed your federal income tax return you can use the Wheres My Refund tool on the IRS website to track any refund you may be owed. This status can last anywhere from a few hours to a few days. Viewing your IRS account information.

After the IRS accepts your return it typically takes about 21 days to get. To help establish your identity many states will ask for the exact amount of your expected refund in whole dollarsYou can find this by signing in to TurboTax and itll be on the first screen. How To Track Your Refund And Check Your Tax Transcript.

You can track your refund status on the IRS website or via the IRS mobile app. The refunds are being sent out in batchesstarting with the. Youll need the following information to check the status of your refund online.

This is available under View Tax Records then click the Get Transcript button and choose the. Taxpayers can start checking on the status of their return within 24 hours after the IRS received their e-filed return or four weeks after they mail a paper return. Social Security number or ITIN Individual Taxpayer Identification Number.

The first way to get clues about your refund is to try the IRS online tracker applications. The American Rescue Plan Act enacted on March 11 2021 provided relief on federal tax on up to 10200 of unemployment benefits a taxpayer. Will display the status of your refund usually on the most recent tax year refund we have on file for you.

Check My Refund Status. 4 weeks after you mailed your return. The Tax Break Is Only For Those Who Earned Less Than 150000 In Adjusted Gross Income And For Unemployment Insurance Received During The Pandemic In 2020.

Wheres my federal refund. 22 2022 Published 742 am. Enter identifying info to get your federal e-file status.

Up to 10 cash back Sign in to verify your exact refund amount. About a month out from the deadline millions of Americans have already filed their 2021 taxes and in many cases are now anxiously awaiting their refunds from the IRS. Calling the IRS TeleTax System at 800-829-4477 or the IRS Refund Hotline at 800-829-1954.

Tax season is in full swing. Return Received Notice within 24 48 hours after e-file. These letters are sent out within 30 days of a correction being made and will tell you if youll get a refund or if the cash was used to offset the debt.

Online portal allows you to track your IRS refund. All they need is internet access and three pieces of information. If you file in early January before the IRS begins accepting returns your e-file status can remain pending for a few weeks.

By Anuradha Garg. The 310 code simply identifies the transaction as a refund from a filed tax return in the form of electronic payment. If you mailed in your return you should wait at least four weeks before checking.

Wheres my state refund. Filing status eg single married. Their Social Security number.

How To Track Your Tax Refund. Sadly you cant track the cash in the way. Online Account allows you to securely access more information about your individual account.

Ad See How Long It Could Take Your 2021 Tax Refund. This means its on its way to the IRS but they havent acknowledged receiving it yet. Find out how to check the status of your tax refund in your state.

To check on your refund youll need to provide your. One of the lesser-known provisions of the 19 trillion American Rescue Plan was a substantial tax break for recipients of unemployment benefits. If those tools dont provide information on the status of your unemployment tax refund.

As of April 15 most recent data available over 78 million tax refunds worth more than 242 billion have been issued in 2022. 24 hours after e-filing. Have your return on hand since youll need it to answer some questions.

The IRS gives some helpful estimates as to when your return will get processed but there are no guarantees. The IRS issues the vast majority of refunds. Accepted youll be able to start tracking your refund.

Lets track your tax refund. You can ask the IRS to trace it by calling 800-829-1954 or by filling out and sending in Form 3911 the Taxpayer Statement Regarding Refund.

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

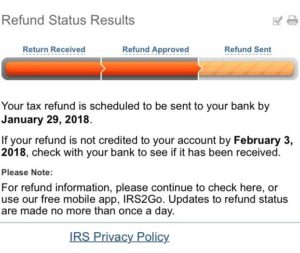

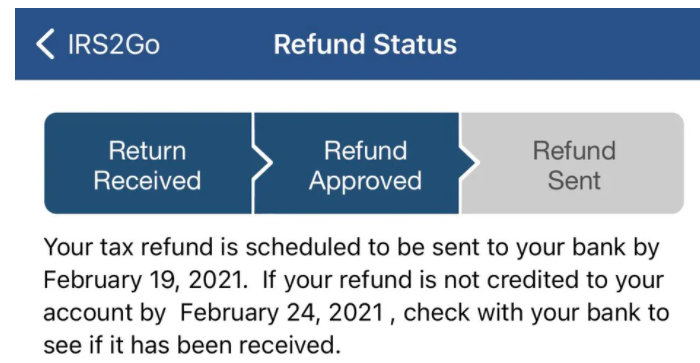

Wmr And Irs2go Updates And Status Differences Return Received Refund Approved And Refund Sent Latest News And Updates Aving To Invest

Why Is It Taking So Long To Get My Tax Refund Irs Processing Backlog Direct Deposit Payment Delays Aving To Invest

Wmr And Irs2go Updates And Status Differences Return Received Refund Approved And Refund Sent Latest News And Updates Aving To Invest

Where S My Refund How To Track Your Tax Refund 2022 Money

Where S My Refund Where S My Refund Status Bars Disappeared We Have Gotten Many Comments And Messages Regarding The Irs Where S My Refund Tool Having Your Orange Status Bar Disappearing This Has

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Irs Refund Tracker Why Is Your Tax Return Still Being Processed Marca

4 Steps From E File To Your Tax Refund The Turbotax Blog

How To Get Your Stimulus And Tax Refund Fast Nextadvisor With Time

Irs Tax Refund Calendar 2022 When To Expect My Tax Refund

Tax Refund Chart Can Help You Guess When You Ll Receive Your Money In 2021

Tax Refunds Deadline 2022 How To Track Your Tax Refund Marca

If Your Tax Refund Check Is Coming In The Mail Here S How To Track It Cnet

Tax Return Refund Delays From The Irs Leave Triangle Residents Waiting For Thousands Of Dollars Abc11 Raleigh Durham

Wmr And Irs2go Updates And Status Differences Return Received Refund Approved And Refund Sent Latest News And Updates Aving To Invest

Waiting On Tax Refund What Return Being Processed Status Really Means Gobankingrates

Check Your Bank Account You May Have Received Your 2021 Tax Refund